|

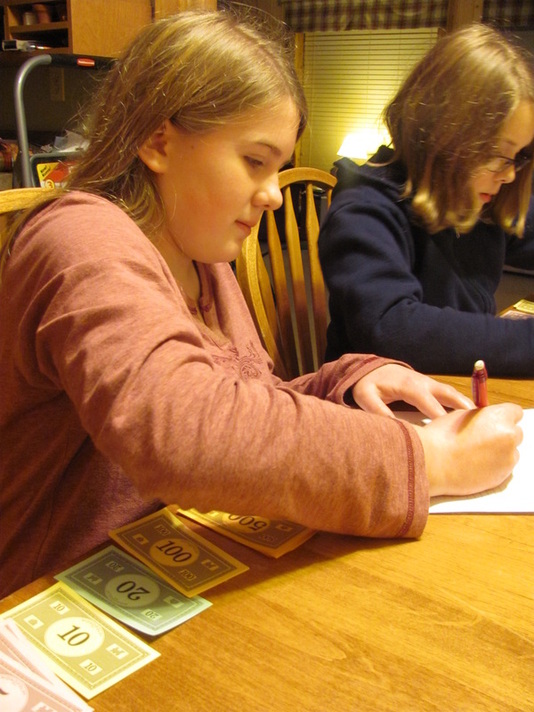

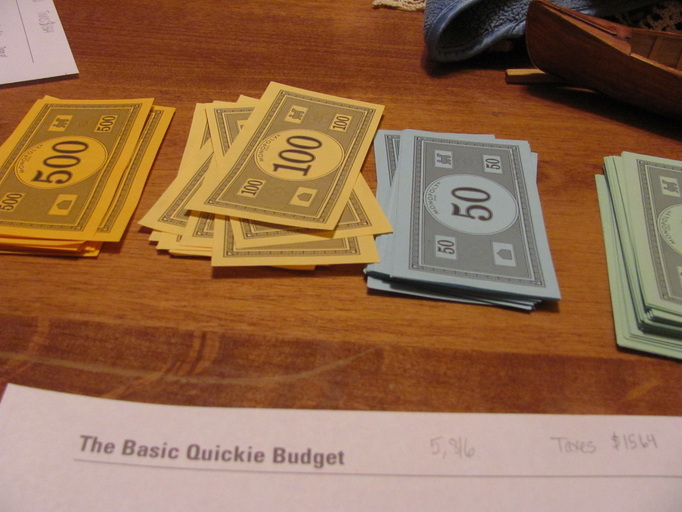

Last week, our family began taking Dave Ramsey's Financial Peace University classes at our church. My husband and I took a financial budgeting class for maybe 8 weeks (?) seventeen years ago, when we were engaged. Those classes with the Ron Blue financial ministry were helpful - oh, more than a few times - in the last 16 years of our marriage. Now, it's time for our children to take a budgeting class with us! Six months after we married, I resigned from my teaching position at the end of the school year and began working in an educational office for a much lower wage - about half of the pay I had received previously. I had enjoyed teaching children, but I longed for a "9 to 5" job so that I could be home in the evening with my husband, not having him competing with mounds of student papers that needed to be corrected each week. It was one of the better decisions I've made in my life. I loved it! Because both of us had lived frugally with our Monopoly money when we were single, in our own apartments (uh, yeah, that is a bit odd - usually financial opposites attract), we were used to spending only what we really needed to spend for daily living. As I remember, we ate out about once a month, went to a few movies each year, kept our gift giving at a minimum (even though I would love to spend tons of money on gifts!), camped and hiked for most of our vacations, and just took things easy financially. We chose monthly organizations and missionaries to support as part of our charitable giving. We bought our clothes from the "clearance of the clearance" racks or twice a year at the huge sales, or second hand stores. We weren't cheapskates, but we definitely were not big spenders. We were trying to be very careful with our Monopoly money! We chose long before we married to plan to live on one income once our names (and bank accounts) would merge and we would sign on the dotted marriage line. For the most part, we were able to do this. We used my paycheck to pay off my car and his truck within a year of being married, as well as paying off my student loans. We were basically debt free, with no consumer debt from credit cards, etc. Once that was paid off, even though I was working at a lower wage job for only nine months each year, we began saving my paycheck so we could have a downpayment on a house. When Kelsi was three months old, we found a house that had been sorely neglected but had potential. Best of all, it had great neighbors and a larger living room, which was important to us because we enjoyed hosting get-togethers with family and friends. No matter that it was in a low-income neighborhood; it was OURS! Once again, we chose to be careful with our Monopoly money. The mortgage loan officer encouraged us to spend more on a house - much more - but we declined. She even tried to include our retirement account monies when figuring out how much we could potentially afford in a monthly house payment. Weird! Even though our tastes in housing wanted something more than we bought, our pocketbook told us that we should instead buy something that we could still afford even if my husband, Elmer, became unemployed or disabled. So, we bought low and have stayed where we are, even though some people have questioned why we live in a neighborhood like ours or why we only have a two-bedroom house. Recently, our family began working on our homework for this first week's Dave Ramsey class, Financial Peace University. Now that our girls are pre-teen/teen aged, we knew that they were ready to begin learning some more in-depth information about planning and setting budgets, and how to be wise with their money for now and in their future. Initially, we were excited about our church hosting these classes, but we hadn't planned to sign up for them. However, after thinking about it and discussing the classes with our girls, we decided sign up our family for the purpose of educating our girls about handling money in a wise way. This week, we were supposed to read four chapters of Financial Peace Revisited and then write out the current budget that we have for our family. While we have become a little sloppier over the years and haven't written out every single expense in our monthly budget, we have had a monthly check-off page to make sure that each bill is paid on time or early. I printed out the budget worksheet for all four of us, and we sat down at the dining room table with our budget binder we've used for years, a calculator, and the Monopoly money. Yes, Monopoly money! We gave the girls each the amount of play money in Elmer's gross income. They weren't surprised to see the money for our tithing and charitable giving disappear from the gross, but when Uncle Sam visited and took away the taxes, they gasped! As do we, every month. It still shocks me how much we pay each month in taxes. Did you know that ancient Romans would form a riot which would quickly turn into a mob, if their tax rates were above 6 percent? Six percent! Oh, my. They would rebel and take over the government if they were here now, I'm afraid! After charitable giving and taxes, they paid the "bank" (my husband and I) Monopoly money for all of our bills. After about 20 minutes, Brittany became quite discouraged. "It's all disappearing!" she shrieked at some point toward the end of the "lesson." Yes, Brittany, it is. That's what happens. We went through each bill, having the girls first guess how much they thought we would spend each month on that item. Then, we told them the actual amount, and they forked over the Monopoly money to Mom (the banker). They didn't like seeing that money disappear! (Nor do we.) This was an excellent lesson for them. Kelsi has always been extremely frugal with her money. She's a "saver", that's for certain. Brittany has always been a "spender", but she has greatly improved on her spending habits over the last few years. We are pleased with her progress. It was nice going to the store with her this last week, and she didn't ask for me to buy anything. She said a couple of times, "I'd like to have this, but it isn't in the budget!" Ahhh...yes. She is "getting it." Hooray! What kinds of things are you doing to help your children learn better money management? I'd love to know - please share your ideas in the comments section below!

7 Comments

1/19/2011 07:13:56 am

I love Dave Ramsey's stuff, and have thought about looking into the Financial Peace materials for my kids- it's awesome that you were able to do classes at your church!!

Reply

5/31/2024 04:27:12 am

Your appreciation means a lot! It's like putting together a puzzle—finding the perfect word is like finding that missing piece that completes the picture of your writing. Keep practicing, and you'll definitely see progress!

Reply

Leave a Reply. |

Hi! I'm Julieanne!

|